OTTAWA - Canada and Japan signed a new battery supply-chain agreement in Ottawa Thursday, as Canada seeks to expand its position in the battery industry and Japan seeks to secure access to lucrative American EV subsidies for its automakers.

Industry Minister FranûÏois-Philippe Champagne was coy about what kind of Canadian subsidies could follow to lure Japanese battery makers into Canada, though he and Natural Resources Minister Jonathan Wilkinson both mentioned discussions underway with Toyota and Honda.

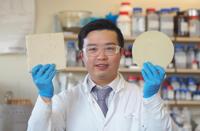

The CEO of Prime Planet Energy and Solutions, the three-year old automotive battery-maker created by Toyota and Panasonic, was also in Ottawa Thursday to sign a separate agreement to work with Vancouver-based FPX Nickel Corp. Panasonic Energy also signed a co-operation pact with Quebec's Nouveau Monde Graphite.

Those deals were separate from the government-to-government "memorandum of co-operation," which Wilkinson said is a typical part of negotiations and business dealings with Japan and its companies, laying out a framework for companies from the two countries to then make their own deals.

He called it a signal "that there is interest on the part of the Japanese in actually looking at manufacturing of batteries in Canada and that Canada is interested in being a supplier to ensure that Japan has access to the kinds of materials that it needs that it does not have domestically," Wilkinson said.

Japan brings technology in mineral processing to the table, as well as battery and auto manufacturing companies, while Canada brings access to critical minerals and an expanding battery manufacturing supply chain.

Japan's industry minister Yasutoshi Nishimura, who travelled to Ottawa to sign the agreement, said it is critical for the two countries to seek out like-minded allies in a world with increasing geopolitical tension.

"Looking back over the past four years, international affairs have become increasingly unstable, with the spread of infectious diseases, Russian aggression against Ukraine and attempts by some nations to weaponize economic independence in the form of coercion for diplomatic and security purposes," he said.

"In this context, the need for co-operation between Japan and Canada has increased greatly. We share common values and are good partners in the Indo-Pacific region."

Both Canada and Japan want to counter China's economic and political dominance in the Indo-Pacific region, as well as in the global battery industry.

Canada launched a new Indo-Pacific strategy last year, and has been trying to do what it calls "friendshoring" ã or co-operating with allies on critical minerals and other technology supply chains to prevent countries like Russia and China from using those supplies to influence global affairs.

For Canada, the deal with Japan is well-timed, allowing it to show growing ties with a key Indo-Pacific ally even as its relationship with India barrels towards rock bottom.

On Monday, Prime Minister Justin Trudeau said Canada's intelligence services have credible evidence that Indian government agents were connected to the shooting death of a Vancouver Sikh leader in June.

Ahead of that bombshell statement, Canada cancelled a planned trade mission to India this fall and paused ongoing trade deal talks.

Trade Minister Mary Ng is expected to lead a trade mission to Japan this fall, saying Thursday at least 100 companies are joining her for that trip.

Canada has laid out tens of billions of dollars in recent years to establish itself as a global battery leader, with investments in more than a dozen battery supply chain and manufacturing companies.

That includes up to $13 billion in production subsidies for Volkswagen to build a battery plant in St. Thomas, Ont., and $15 billion in production subsidies for a Stellantis battery plant in Windsor, Ont.

Last year, Champagne was in Japan three times making the pitch for Canada's battery material capacity to Japanese automakers and electronics giants.

Canada also could help Japanese automakers produce electric vehicles that qualify for a big consumer tax rebate in the United States. The rebate, which lowers the cost of EVs to buyers by several thousand dollars, is limited to vehicles manufactured in North America with mostly North American-made batteries.

This report by üСÜꪤüýò¿Øéóæòêü was first published Sept. 21, 2023.